Community Solar and Affordable Multifamily

An Introduction

By David Godschalk

5 min read

The prospects are changing for combining solar energy production and affordable housing. Historically, this combination has been a complicated proposition: doable, yes, but also subject to uncertainty and complications relating to eligible basis and energy use.

That is changing quickly. The passage of the landmark Inflation Reduction Act of 2022 (IRA), together with improvements in both the solar panel market and incentives for renewable energy, make adding solar a potentially important opportunity for new and existing Low-Income Housing Tax Credits and other multifamily properties.

For developers and owners new to renewable energy, it is worth noting that this is complex. Experienced LIHTC developers will appreciate that investment tax credits for clean energy (ITCs for short, although the statutory terminology is changing) are subject to a tax regulatory framework that looks comfortably familiar in some ways but is dramatically different in others. On top of the tax issues, solar regulatory markets and utility policies are not uniform.

For developers new to solar, these points are worth considering:

Challenges of Financing Through LIHTC. Although it has long been possible to include solar equipment in LIHTC financing, the accompanying challenges have discouraged some developers. The general scarcity of allocation in some markets can make it difficult to add several million dollars of additional costs. Similarly, restrictions on the use of the energy produced under the “common area facility” rules have tended to undercut the commercial appeal of such projects.

Community Solar Programs Provide Support. For “free-standing” solar projects that are financed outside the LIHTC deal, the picture is more appealing. The energy produced can be sold commercially through ‘community solar’ or ‘solar for all’ programs that allow producers of clean energy to monetize that production by selling it to participating community subscribers or pooled customers. Participating subscribers can include building residents or other families in the area.

(Feb. 13, 2024).

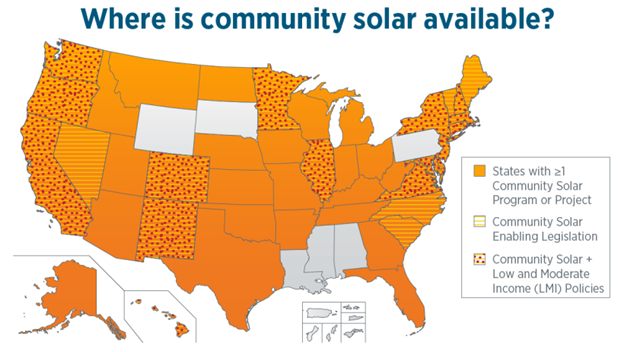

The community solar model is growing. According to the U.S. Department of Energy, there is at least one community solar project in 43 states, and the District of Columbia has 17 states and D.C. that have low-income community solar legislation.

For these projects, no LIHTC allocation is required, and the ITC does not require applications or Qualified Allocation Plan (QAP) competition (although bonus credits are competitive). Importantly, these solar facilities can be installed on new or existing multifamily projects.

Bridge Financing and Sponsor Equity. For solar projects financed with investment credits, one important difference for developers is that credits are typically sold at project completion. This means that projects often rely on some combination of construction loans and/or sponsor equity, which is taken out through a combination of tax credit equity and permanent debt. Because development costs for solar are much lower than for multifamily, the sponsor equity requirement may not be a barrier to many developers. Still, the lack of liquidity in the bridge market has been a challenge.

Deal Structure for ITCs. Until recently, a typical ITC deal used one of two structures: a sale-leaseback or a limited partnership with an investor. The partnership model was not unlike the LIHTC model but with a shorter time horizon and a greater emphasis on economic returns to justify higher credit pricing.

The IRA added new options, including a direct transfer of credits to an investor, which can also be coupled with the partnership model to realize value on depreciation and cash flow. For projects owned by nonprofits or local governments, the IRA created an “elective transfer” or “direct pay” option, where the credits can be effectively redeemed with the Treasury for face value (i.e., without reductions for investor yield) – a valuable option for eligible projects.

Bonus Credits. Importantly for affordable housing, the IRA added a competitive “environmental justice” bonus credit for 2023 and 2024, which is available to projects in low-income communities (under the same test as the New Markets Tax Credit) or meeting other criteria, including an option for projects installed on affordable housing where at least 50 percent of the financial benefits of the electricity produced are allocated equitably among the residents. This bonus credit could bump the base 30 percent energy credit as high as 50 percent.

New Financing Opportunities. If the prospect of commercial income, improved credit options, and potential bonus credits aren’t enough to make these deals appealing, the anticipated funding of the Greenhouse Gas Reduction Fund (GGRF) program is expected to result in $27 billion of government funding to support solar and other renewable projects. This represents a major injection of liquidity at below-market terms and is expected to catalyze new solar development.

Complexity. Solar projects can be technically complex, but a good project engineer or contractor can steer you through that process. The more challenging aspect is navigating the complicated overlay of state and local rules and incentives combined with the policies of the local utility provider. There are vast differences between localities when it comes to installing and operating solar projects, and before proceeding with any deal, it’s important to know whether the local rules support your project. Experienced solar developers or advisors can help you navigate this process.