Green and Resilient Retrofit Program Starting to Take Off

By Mark Fogarty

7 min read

The Green and Resilient Retrofit Program (GRRP), authorized by the Inflation Reduction Act (IRA), continues to ramp up now that the first transactions have closed. The Department of Housing and Urban Development (HUD) program provides funding for direct loans and grants to projects that improve energy efficiency and sustainability or address climate resilience for eligible HUD-assisted multifamily properties.

Though the first GRRP transaction, for an HVAC retrofit to the Bauer House in Quincy, MA was for a modest $750,000, HUD has $837 million in subsidy funds to underwrite $4 billion in lending authority under GRRP through an IRA allocation.

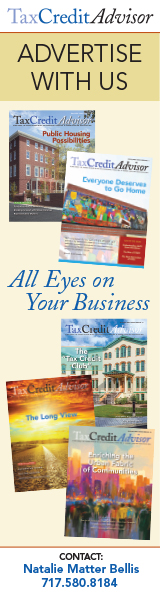

That’s the good news. The bad news is that the deadlines to apply for all three categories of GRRP funding (they are called “cohorts” in this program) have passed, leaving latecomers to hope this program will be offered again.

Alex Rosso, partner of affordable housing and real estate at Nixon Peabody, says the funding authority increases significantly across the three cohorts that comprise GRRP: Elements ($140 million); Leading Edge ($400 million); and Comprehensive ($1.47 billion).

There is a possibility more funding will be available if some applicants change their requests from grants to loans, freeing up funding authority, he says.

Nixon Peabody advised on the Bauer House deal, which closed in April. The building was originally constructed in 1996.

Does the firm have an appetite for more of these kinds of deals? “We are working on a number of other GRRP transactions and hope to do more,” says Rosso.

The total scope of work at the Bauer House, a 75-unit four-story building, was $3 million. “$750,000 of the GRRP funds were used for a new HVAC system and the balance was used for various repairs, including Americans with Disabilities Act (ADA) accessibility and Uniform Federal Accessibility Standards (UFAS) upgrades, roof repairs, ceiling replacement, flooring and carpentry upgrades, and plumbing and electrical upgrades,” according to Rosso.

Nixon Peabody worked with a nonprofit owner, Wollaston Lutheran Church, which owns several similarly sized HUD-assisted multifamily properties in and around Quincy, Rosso says, with 74 units under Section 202 Supportive Housing for Low Income Elderly.

Presentation to NH&RA

Rosso gave a detailed accounting of the GRRP to the Summer Institute of the National Housing & Rehabilitation Association.

According to his presentation, GRRP provides funding to multifamily property owners for retrofits aimed at:

- Carbon emission reduction;

- Enhanced energy- and water efficiency;

- Energy and water benchmarking;

- Improved indoor air quality;

- Climate resilience upgrades;

- Building electrification;

- Zero-emission electricity generation;

- Energy storage; and

- Low-emission building materials or processes.

The program will be used primarily for HUD multifamily assistance programs, such as HUD Section 8 project-based rental assistance HAP contracts, including Rental Assistance Demonstration (RAD) contracts executed before Sept. 30, 2021. Also, Section 811, Section 202 Project Rental Assistance Contracts (PRAC) Direct Loans and pre-1972 Section 202 Direct Loans.

“Applicability outside of these specific HUD programs is limited,” Rosso notes of the number of eligible programs. Public housing and properties with vouchers are not eligible.

Though the process can be complicated, HUD’s done a good job with GRRP in publishing notices and updates, Rosso says. HUD’s website “is really good on this.”

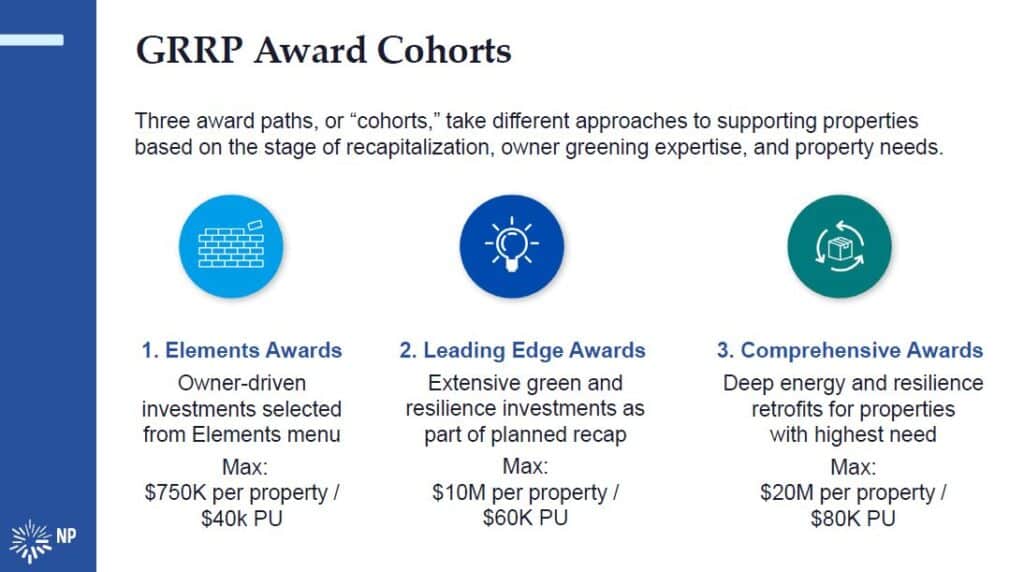

As previously stated, there are three different award “cohorts.” Both grants and loans are possible with each of the three.

The three-tier approach is “to make the program accessible to different projects and different owners both in terms of where in the recapitalization process their project is and also the level of experience that the owners have,” Rosso told the NH&RA meeting.

The Bauer House project was in the “Elements” cohort, which is limited to $750,000 per property and $40,000 per unit. A higher funding limit is available in the other two cohorts.

Elements the Simplest

Elements awards “are the simplest and fastest of the three cohorts. They are modest awards for greening and resilient improvements based on an approved menu of rehab work.” With an Elements award, “you’re well on the way to a recap transaction, tax credits or submitted FHA loan application. It is supposed to complement existing financing. You can execute quickly on Elements once you get your award letter,” Rosso says.

The Bauer House project, for instance, closed four months after the issuance of the GRRP award letter.

For a “Leading Edge” award, an owner would apply with a recap program they are working on, Rosso says. The endgame is to receive one of the passive recertification designations. He notes Leading Edge has much bigger dollar caps than Elements: $10 million per property and $60,000 per unit.

“It requires a demonstration of capacity. You need to be able to show some sort of experience in achieving one of the green certifications that’s out there,” according to Rosso.

“Comprehensive” is the largest cohort in dollars and the most complicated at $20 million per project and $80,000 per unit.

HUD is closing the simplest transactions first, Rosso says. Since the Bauer House deal closed, a handful of other Elements awards have closed, though many more have been awarded (but haven’t closed yet). A Leading Edge award could close by the fourth quarter of 2024.

“Comprehensive, I’d be surprised if any of those deals close by the end of the year,” says Rosso.

At the meeting, he provided examples of potential projects in each of the cohorts.

- Elements: The owner is advanced in planning and financing a recap transaction and will replace the in-unit HVAC systems with higher-efficient electric HVAC systems;

- Leading Edge: The owner is ready to move forward with a complete renovation to a Passive House certification financed by Low Income Housing Tax Credits, a new first mortgage, a GRRP loan and other sources; and

- Comprehensive: The owner is in the early stages of planning a LIHTC-financed renovation and needs additional funding for green and resilience improvements.

“You cannot switch from one of these cohorts to the other,” Rosso pointed out to attendees.

The maximum time you have from when you get the award to when you close is 12 months.

There are a lot of requirements that go with these programs, Rosso says. General contractor fees are capped at 14 percent, for instance.

“That was something we ran up against on our transaction. You can hit 14 percent fairly easily.”

The developer fee limit is 15 percent, “with some flexibility.”

The number of moving parts can make for a complicated closing, according to Rosso. At Bauer House, “our transaction involved FHA-insured financing, GRRP funds and a RAD-to-PRAC conversion. There were a lot of HUD attorneys.”

GRRP funds are not disbursed until 30 days after closing and only 90 percent of GRRP can be available prior to completion.

HUD for its part lauded the Bauer House deal saying, “This project represents the first instance of the incorporation of a GRRP award into a construction project to increase the energy efficiency and climate resilience of the property.” It also noted:

- As of March 28, 2024, HUD has awarded $544.4 million in GRRP funding to improve 109 properties in 38 states and the District of Columbia. These GRRP investments will improve over 12,600 rental homes;

- GRRP projects range from targeted upgrades supplementing in-progress recapitalization efforts to major net-zero renovations; and

- More than 700 properties have also signed up for HUD’s free energy and water consumption benchmarking service, also funded through the IRA. With benchmarking, HUD-assisted housing property owners can better understand the energy and water consumption at their properties to assess potential upgrades.

View the full presentation at NH&RA’s On-Demand Learning Center.