Rolling Up Rural Deals

Preserving Aging Rural Housing Through Bond Finance

By Mark Fogarty

6 min read

Tax-exempt bond finance can be brought to bear on one of the nation’s most pressing needs: the preservation of aging rural housing portfolios.

That’s the philosophy of Will Eckstein, senior vice president of Raleigh-based Harmony Housing Affordable Development Inc. (HHAD).

“We’ve done a lot in the rural space since 2008,” says Eckstein. “We cut our teeth on the Rural Development Section 515 program and have a tried-and-true method,” he says, referencing the U.S. Department of Agriculture’s rural rental housing loan.

“We’re up to almost 17,000 units preserved, including a good amount in the rural space,” he says, in states including Florida, Georgia, Tennessee and Illinois.

The Section 515 program has been successful nationwide, funding some 12,000 properties and 389,000 units. About 300,000 of those units are subsidized, according to HHAD.

The choice of North Carolina for this package came down to “where there was a need and where we can have the biggest impact within the communities we are serving,” Eckstein says.

“There’s such a need across all rural communities,” he says. “This particular effort in NC is one of many portfolio preservations we’ve done in a rural area over the past 15 to 20 years,” adding, “Each has its nuances and personality.”

All too often in rural communities, “there’s only one place to live. There’s not a lot of options. And preserving what housing is existing is really, really important. Some of those communities haven’t seen new housing investment or development in years.”

And although these rural communities “may have less population, that doesn’t mean that they don’t deserve a place to live nor have a need for it.”

And it’s not just in rural communities. “The housing crisis across the country, well, everybody’s feeling it,” he says.

HHAD has worked with a “like-minded” partner that owns and manages existing RD515 portfolios similar to those owned by Fitch Irick of Charlotte, NC. “We are exploring other opportunities and collaborations with them,” Eckstein says. “Their largest communities and holdings are in North Carolina, so that’s where we focused first.”

“I’d been talking to them for several years,” Eckstein says, “but we got serious in the last couple of years about putting all the pieces of the puzzle together to push this across the finish line.”

Fitch Irick owns the properties, says Eckstein. “Our role is as a developer partner. We source the funding, then handle the complete transaction, including overseeing the development, legal, financing and and renovation of the multiple projects.”

Parker Construction is the General Contractor. Once construction is over, HHAD will step aside while Fitch Irick owns and operates the communities long-term, “something they do extremely well.”

Eckstein broke out HHAD’s recent North Carolina rural preservation effort at National Housing & Rehabilitation Association’s annual meeting.

Some Big Numbers

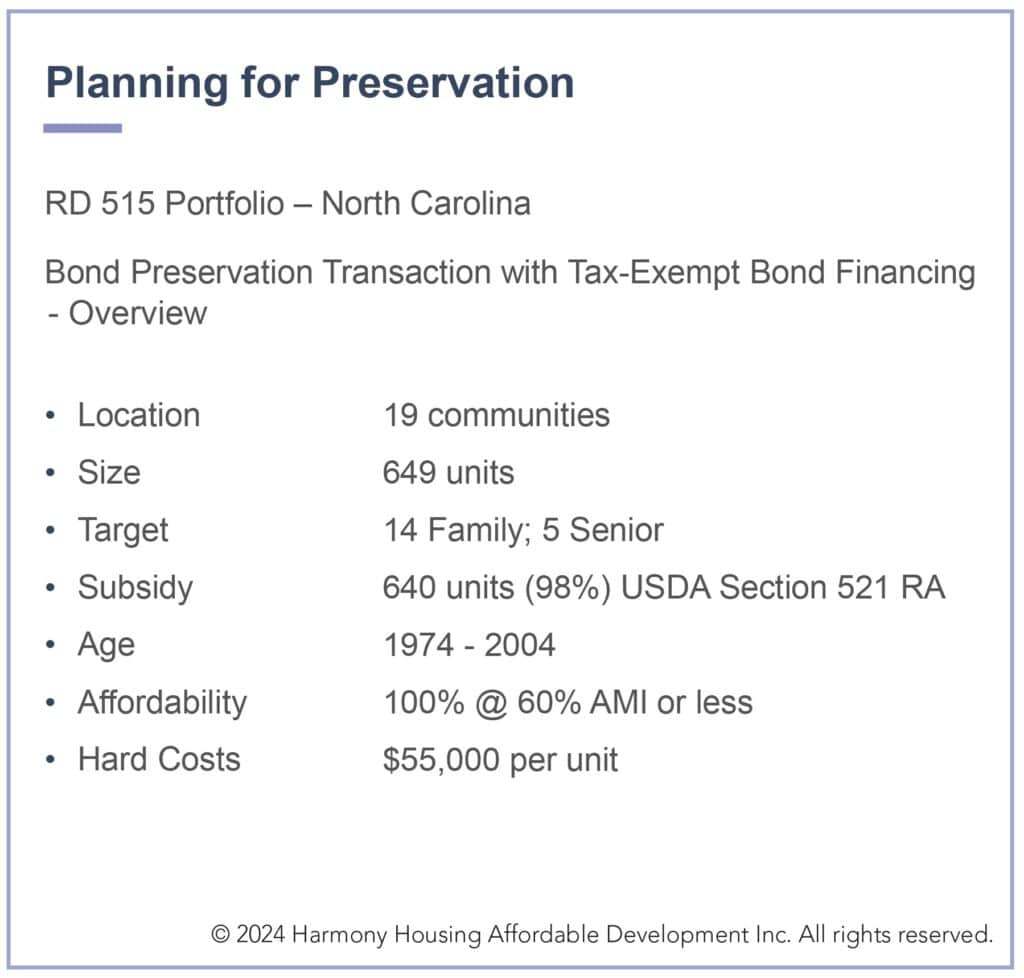

The numbers are impressive: HHAD’s collaboration with Fitch Irick includes 19 communities, totaling 649 units, at average hard costs of $55,000 per unit.

“They desperately needed the investment and preservation,” he says.

Fourteen of the communities are for families and the remaining five are for seniors. Almost all the units (640) have a subsidy from the United States Department of Agriculture under its Section 521 Rental Assistance program.

The age of the units ranges from 20 to 50 years old. All the units are now restricted as affordable at 60 percent of area median income or lower.

“Construction has started,” Eckstein says. “It’s a rolling construction process that will take approximately 24 months to complete them all with the average per project at six months or less. We typically do a true in-place rehab, which means there is minimal disruption to existing residents. Some exceptions require a little bit of shuffling, the accessible units may be one of those cases, but everyone has the right to return.”

The work being done “is not just sugarcoating. It’s a true repositioning and modernization of the units, including replacement of cabinets and appliances, bathrooms fixtures, mechanical upgrades, as well as roofs and other building and site upgrades. Of course, it varies from site to site depending on what is needed. We do an extensive pre-construction assessment upfront to determine the most efficient way to use the hard cost dollars. It’s a comprehensive scope of work that truly repositions the asset.”

Having multiple construction projects going at the scattered sites at the same time is a good way to achieve efficiency, he says. He points out this helps local economies as the teams working on the construction benefit area hotels, restaurants and other local businesses.

“It’s very impactful” to these smaller communities, “where there may not be that kind of traffic on a regular basis,” he says. And there can be local employment on the housing worksites.

Sources include $46 million in tax-exempt bond issuance, $27 million in four percent Low Income Housing Tax Credit funds, a $37 million Fannie Mae loan from Greystone and seven other sources (see sidebar).

The North Carolina Housing Finance Agency issued the tax-exempt bonds. Eckstein says North Carolina is an attractive state to work in “because of the availability of funding there” through the four percent tax credit.

An Alignment for North Carolina

Eckstein says most of the communities are in scattered sites in the eastern and western sections of North Carolina.

“We honed in on North Carolina because there were existing communities, and they were in need of a rehab. The stars, the moon and the sky all aligned together.”

He also says HHAD would like to zone in on opportunities like this “and replicate them over and over again. We were the first to orchestrate transactions of this kind and scale and we remain committed to doing this work as part of our core business.”

Keys to success on a project like this? An experienced developer team and strong relationships with the syndicator, lender, general contractor, architect, state Housing Finance Authority (HFA) and USDA Rural Housing Service, Eckstein says.

Partners included “everyone from USDA Rural Development, the Department of Housing and Urban Development and the North Carolina HFA. CAHEC was the LIHTC syndicator, whom HHAD had previously partnered with on several occasions.

“It takes a village to pull these things together,” he comments.

Partners “vary from deal to deal, but we have a bunch of folks we can go to,” Eckstein says. Commenting on the ten partners in the capital stack, he adds, “That’s the only way deals are getting done in today’s environment.”

HHAD is part of a for-profit/nonprofit structure. HHAD, a newly formed, wholly owned subsidiary of Harmony Housing, acquired the property development, development manager and advisory business of Greystone Affordable Development in December 2023.

Fitch Irick, based in North Carolina, “is a real estate investment manager specializing in workforce housing and affordable housing. The company acquires, develops and manages multifamily rental housing that utilizes local, state and federal tax-advantaged financing programs,” according to the company.

Advertisement

$150 Million in Sources

Tax-Exempt Bonds……………………………… $46 million

Source Debt, FNMA………………………………. $37 million

Sub debt, USDA 515…………………………………… $17 million

Four Percent LIHTC……………………………….. $27 million

CMF…………………………………….$2 million

Soft funds………………………. $2 million

Bond Reinvestment Income……………………………… $4 million

Other—Surplus RR………………………………………… $6 million

Investment Earnings……………………………. $4 million

Developer Contributions………………….. $6 million

Source: Harmony Housing Affordable Development