Winds of Change Repurpose Old Aeolian Factory in CT

By Mark Fogarty

6 min read

Player pianos always have had an aura of magic as beautiful music emerges from them seemingly without human assistance. Now, some industrial magic is set to transform an old player piano factory in the north end of Meriden into beautiful multifamily units.

The factory belonged to the Aeolian Company, located at 85 Tremont Street – a name imbued with a touch of magic, as an Aeolian harp is played solely by the wind, without human intervention.

The nearly 140-year-old blighted property is slated for redevelopment into 82 mixed-income apartments, thanks to the efforts of developer Trinity Financial and the lender/investor KeyBank, utilizing the Low Income Housing Tax Credit program along with State and Federal Historic Tax Credits.

The construction also includes the remediation of some brownfield contamination at the site.

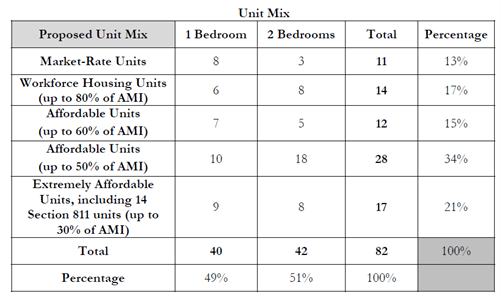

Fourteen units will be funded through the federal Section 811 program, which offers supportive services for households earning at or below 25 percent of the area median income (AMI). Additionally, three units will be available for households at or below 30 percent AMI, 28 units at or below 50 percent AMI, 12 at or below 60 percent AMI, 14 units at or below 80 percent AMI and 11 units will be unrestricted, market-rate apartments.

According to the developer, amenities will feature a community room, children’s playroom, fitness center and indoor bike storage, all conveniently located within walking distance of local attractions and public transportation.

Trinity Financial is committed to achieving Enterprise Green Communities certification for the project by focusing on sustainability through energy-efficient upgrades. These upgrades include a new window system, high-efficiency HVAC, Energy Star appliances, LED lighting and solar panels on the roof.

Dan Drazen, vice president of development for Trinity Financial, highlights that his firm has successfully completed several adaptive reuse projects for old mills and textile factories across New England. The Aeolian site was particularly appealing due to being “a good scale,” he says, meaning it has an area of 123,000 square feet that will yield 82 apartments.

An Expanded District

Drazen notes that in 2020, the city expanded its adaptive reuse district to include the old Aeolian site. This regulation aims to promote the flexible reuse of historic industrial buildings, preserving their value, supporting neighborhood character and fostering Meriden’s economic, cultural and general welfare. Additionally, the city invested $2.2 million in renovating the North End Fields, which are located adjacent to the site. This public-private partnership aims to revitalize an entire block of North Meriden.

The development was about two-thirds occupied by a mix of industrial tenants, though Drazen believes this “was not the best use of the property.” He notes that the Meriden site was the first purpose-built facility developed by Aeolian, where both player piano scrolls and player pianos were manufactured.

Aeolian operated at the property from 1877 until 1930.

Although the building has numerous code violations that need to be addressed, Drazen states that the structure’s shell remains in relatively good shape, largely because the building was not left vacant. The tenants “kept a pretty good eye on things,” he says.

“There is some structural damage, but overall, it’s in pretty decent shape for a building of this age.”

“The building is really a complex of 13 interconnected smaller units,” according to Drazen. However, one unit—the Record Production Building—does not align with the overall plan and will be demolished.

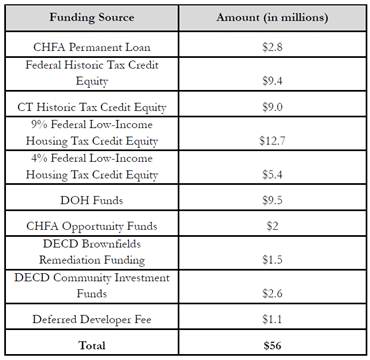

In addition to the tax credits, the financing includes a permanent mortgage from the Connecticut Housing Finance Authority, along with some soft debt. The total development cost comes to $56 million.

The financing strategy paired State and Federal HTCs with LIHTCs. KeyBank served as the equity investor for all tax credits, except the State HTCs, which were provided by the state utility Eversource. The high percentage of affordable housing units at 85 Tremont allowed a greater allocation of State HTCs.

Approximately 65 percent of the project’s funding will come from LIHTC equity and HTC equity. Trinity has secured $24.5 million in construction financing from KeyBank, $13.4 million from the Connecticut Housing Finance Authority, $9.5 million from the Connecticut Department of Housing and $4 million from the Connecticut Department of Economic and Community Development, which includes $1.5 million of Brownfields funding.

Construction Is Underway

Construction started in May of this year and is expected to be finished by the fourth quarter of 2025. Trinity aims to preserve as many of the original historic details as possible, including interior brick walls and original columns and beams, while incorporating modern upgrades, such as energy-efficient replacement windows designed to closely resemble the originals.

Anna Belanger, vice president and senior relationship manager in KeyBank’s Community Development Lending and Investment Group, agrees that the $52 million her bank provided for 85 Tremont is significant.

“The project provided a unique opportunity to address the need for affordable housing, while still preserving and revitalizing a historic structure within a community that KeyBank values,” she says.

She broke down the KeyBank investment as “$24.5 million of construction loan financing, as well as a combined $27.5 million of Federal LIHTC and HTC equity: Federal LIHTC ($18.1 million) and HTC ($9.4 million).”

Asked how the investment fits in with KeyBank’s community development philosophy, she says, “We are dedicated to helping communities thrive and are excited to see this project drive economic revitalization for the Meriden community.”

Belanger notes the complexity of the deal.

“In order to incorporate the nuances of each financing type, we had to separate out the four and nine percent LIHTC transactions through a two-unit condominium structure. Our partners at Trinity Financial were very collaborative, and together we proposed a financing structure that maximized the amount of LIHTC equity for the project and ultimately created additional housing for the community,” she says.

The complexity of the deal proved to be a positive, Belanger says.

“The complexity of the financing was a challenge, but it was also an opportunity to creatively combine the use of several financing vehicles to maximize proceeds for construction. This ultimately created more affordable housing while carefully preserving a historic structure in need of revitalization that has been a part of the community for decades.”

The result? “The revitalization will directly benefit the community by beautifully preserving the historic character of the building while creating new affordable housing for families. The city has prioritized improvements in the neighborhood, including upgraded athletic fields and playgrounds, which will be adjacent to 85 Tremont,” says Belanger.