Fannie Mae and Freddie Mac Set for Strong 2022

By Pamela Martineau

7 min read

Higher Multifamily Purchase Volume Caps and LIHTC Increases

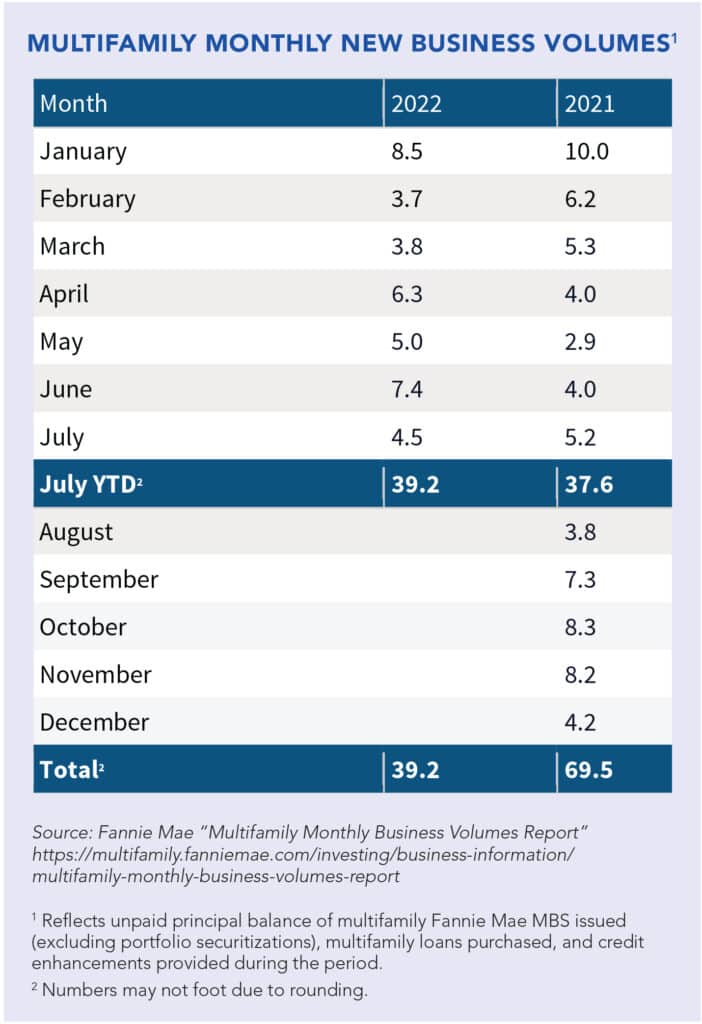

Fannie Mae and Freddie Mac Multifamily are experiencing an uptick in purchase volumes as the debt capital market environment appears to be shifting in the latter half of 2022. Both agencies are tasked with deploying liquidity to the multifamily market while remaining within the Federal Housing Finance Agency’s (FHFA) loan purchase volume cap, which was increased to $78 billion in 2022 from $70 billion in 2021.

As of the end of June, Freddie Mac’s multifamily business activity was $29.6 billion and Fannie Mae’s was $34.7 billion, but agency volume is expected to pick up in the second half of 2022 as other debt capital providers assess market conditions.

“We typically see an uptick in volume towards the end of the calendar year, and that will be true for 2022 as the market environment has changed,” says Steve Johnson, interim head of production and sales for Freddie Mac Multifamily. “The debt market was extremely competitive at the beginning of the year, but many capital providers are taking a step back.”

Kim Betancourt, CRE vice president, Multifamily Economics and Strategic Research at Fannie Mae, writes in a mid-year forecast that multifamily sector demand will remain strong throughout the remainder of the year, but will likely moderate.

“The multifamily sector experienced strong demand during the first half of 2022, resulting from a combination of favorable demographics, continued job growth, rising wages and increased renter household formations,” Betancourt writes in a midyear report on the Fannie Mae website. “This demand is expected to continue for the remainder of the year, albeit at a more moderate pace. That said, it is important to note that although national trends are expected to remain above average over the next six months, multifamily fundamentals and demand can, and do, change and will vary by metro, submarket and, in some cases, by neighborhood.”

Both Freddie Mac and Fannie Mae experienced a strong year in 2021, providing nearly $70 billion in financing each to support the multifamily sector. Fannie Mae’s funding of multifamily affordable housing rose more than 23 percent that year to the highest volume in the history of the 33-year-old program. Freddie Mac also chalked up a great year for its Targeted Affordable Housing Business, with $9.6 billion in volume.

Strong Year Expected for Agency LIHTC Equity Investments

In September 2021, to help increase the stock of affordable housing for low- and very low-income individuals, the Biden administration and the FHFA increased Fannie Mae’s and Freddie Mac’s cap for Low Income Housing Tax Credit equity investments from $500 million a year to $850 million a year. That increase has bolstered investments in LIHTC properties.

“Freddie Mac set a record with LIHTC equity investments in 2021 with $675 million,” says Johnson, of Freddie Mac. “We expect to have another strong year in 2022 with a new annual cap of $850 million. These investments provide thousands of highly affordable housing units in some of the most underserved communities each year. We’re thrilled by the growth we’ve seen in our LIHTC equity business. It’s one of several ways we can support new supply.”

The enhanced agency activity adds to the overall strength of the LIHTC market. According to a report released by Fannie Mae, LIHTC sales nationwide increased dramatically in 2021. Sales of properties assisted with LIHTC fell during the start of the pandemic, dropping to $4.3 billion in 2020 from $6.8 billion in 2019. But the stable performance of the federally assisted properties during the height of the pandemic in 2020 enticed more investors to the space in 2021. In 2021, investors purchased over $23 billion of LIHTC properties, about 2.5 times the average annual sales volume recorded in the three years prior to the start of the pandemic. Sales of individual properties grew to $5.4 billion in 2021 from $2.6 billion in 2020. Portfolio sales rose to $17.7 billion in 2021 from $1.7 billion in 2020, largely due to Blackstone’s Real Estate Investment Trust (BREIT) purchases.

According to a report written by Fannie Mae Economic Advisor Tanya Zahalak, investor interest in LIHTC remains strong, but there may be some headwinds ahead.

“Construction costs are rising, so it is more costly to build new affordable LIHTC properties. In addition, the temporary 12.5 percent increase in the amount of nine percent credits implemented by the Tax Cuts and Jobs Act enacted in December 2017 expired in 2021,” writes Zahalak. “Further, the four percent floor for four percent LIHTC credits will be less valuable in the current environment of rising interest rates, and some states have reached the cap on their private activity bond allocations. Despite these challenges, interest in the multifamily affordable asset class is growing, showing that more private capital could flow to affordable segments.”

Another way in which Freddie Mac is supporting affordability and supply is through its forwards product. A forward commitment allows the borrower to hedge interest rate risk on permanent financing after the conversion from construction.

Sustainability and Impact Bonds

Fannie Mae and Freddie Mac both securitize multifamily mortgages through impact bonds.

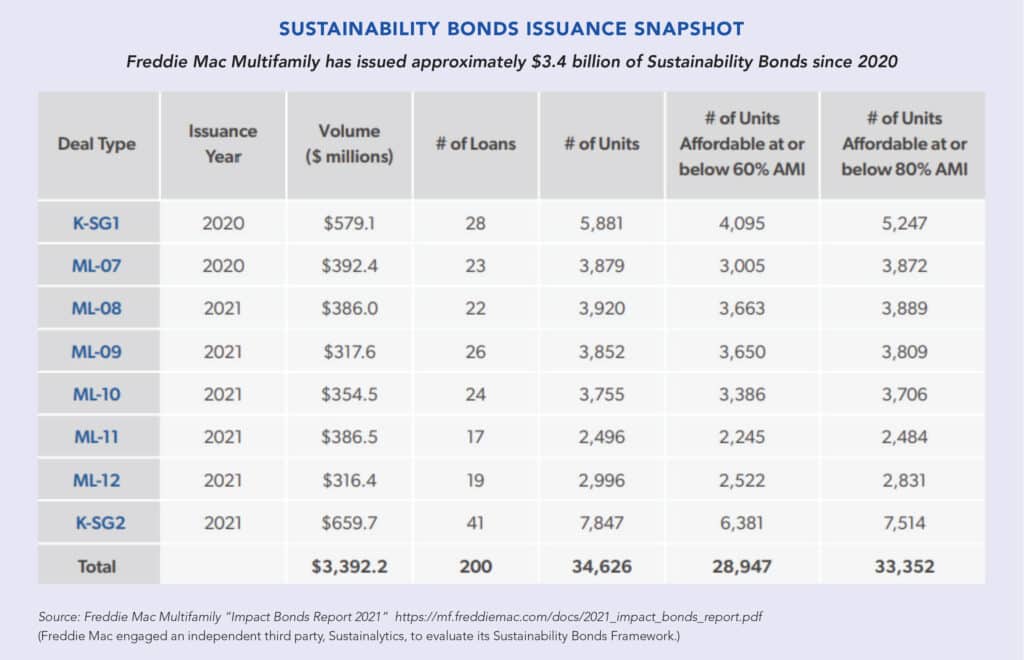

According to Freddie Mac’s 2021 impact bonds report, the bonds provide investors an opportunity to support multifamily properties that address persistent housing challenges, including those related to environmental and social issues. Freddie Mac’s Green Bonds are backed by multifamily loans that incentivize energy- and water-efficiency improvements at workforce housing properties. Social Bonds focus on supporting affordable housing by providing liquidity to financial institutions with a distinct mission of addressing affordable housing challenges or providing financing targeted toward under-served populations. Sustainability Bonds attract capital to support residents’ economic mobility and, more broadly, generate community economic growth and sustainability.

“Impact bonds, whether they’re social, sustainable or green, help support our most mission-driven business,” says Johnson, of Freddie Mac. “Since 2019, we’ve issued more than $10 billion through impact bonds, driving investor capital to the effort to provide safe, efficient and affordable workforce housing.”

Fannie Mae’s Multifamily green bond issuances also are backed by properties with Green Building certifications and, similar to Freddie Mac, include U.S. rental housing stock that is retrofit to become more energy- and water-efficient. Properties in Fannie Mae’s Green Bond Business must report the property’s annual ENERGY STAR rating for tracking energy performance over the life of the loan. Fannie Mae’s multifamily products include the Green Rewards Mortgage Loan, which provides incentives for borrowers to make property improvements that target specific reductions in energy and water use and/or generation of renewable energy; and the Green Building Certification (GBC) Mortgage Loan, which offers incentives for borrowers with multifamily properties that possess green building certification.

According to Fannie Mae documents, loans that use the Green Financing products are eligible to be securitized as a Fannie Mae Green Bond, which are issued as Multifamily Green Mortgage-Backed Securities (MBS). Through the Delegated Underwriting and Servicing (DUS®) model, a Multifamily DUS MBS is generally backed by one green mortgage loan on one property. Green Guaranteed Multifamily Structures (Fannie Mae GeMS™) is a re-securitized pool of Multifamily Green MBS that is structured as a Real Estate Mortgage Investment Conduit (REMIC), providing greater collateral diversity to investors.

Increasing Access to Affordable Housing

In April, Fannie Mae announced its Expanding Housing Choice initiative, which provides a new pricing incentive for Texas and North Carolina property owners who accept Housing and Urban Development (HUD) Housing Choice Vouchers.

“As we fulfill our mission, we are working with the housing community to expand access to affordable housing for those who need it most,” Hugh R. Frater, former CEO of Fannie Mae, said in a press release.

Expanded Housing Choice will be executed out of Fannie Mae’s Multifamily Delegated Underwriting and Servicing platform.

Johnson, of Freddie Mac, says Freddie Mac is “on track for a record year of affordable business” and to “hit all our mission-driven goals.”

“We’re facing an affordability crisis with rents on the rise in every market, so this work is particularly impactful for lower-income households who are finding it increasingly difficult to find housing.”