Guest Column: Affordability, Viability and Livability

By Harold Nassau & Anker Heegaard

9 min read

Rent Levels in Affordable Housing

This article is adapted from a session presented at the 2021 Consortium of Housing and Asset Management (CHAM) Conference.

Affordable multifamily housing is a perpetual struggle between mission and margin. Providing affordability can run against the grain of viability. With the pandemic, affordable housing providers found this balance even more challenging to achieve: residents’ incomes were affected while the relentless costs of operating properties continued. ‘Affordable’ rents often don’t permit adequate resident services or adequate long-term capital replacements. Part of this challenge is operational, but a significant cause is built into the 30 percent of income housing cost standard and how we define and produce ‘affordability’.

The affordable housing crisis and the financial pressures on the many families it serves has made owners and managers of affordable housing dig deeper toward better understanding the affordability being achieved, rather than just the intended or ‘reg-restricted’ affordability. Unlike the means tested and annually recertified tenants in Section 8 and Rural Development properties, we only know the initial incomes of the Low Income Housing Tax Credit (LIHTC) residents. For these essential populations, we know increasingly less over a property’s lifecycle about the actual affordability of rents for current tenants. Against this, the standard, which asserts that 30 percent of income is ‘affordable’ is inadequate as even ‘affordable’ apartments to lower-income Americans are too expensive.

The pandemic has shone a bright and harsh light on this problem. Owners have been rightly worried about both their properties’ viability and affordability of rents for their residents. How can owners serve their residents and protect their investments? We also want to reopen the question of what ‘affordable’ means. In the absence of actual income data, we will look at a number of proxies to gain some understanding of the issue and to frame questions for further investigation.

While quality affordable housing has many components—including at least location, services, condition, features and amenities—the key element of affordable housing is affordability itself. To a renter, this is the heart of the value proposition, and left to ‘choose’ between various vital outcomes, many renters simply need the extra $50 in their pocket. This struggle between keeping rents as affordable as possible, while also providing resilient, equitable and sustainable housing is a fundamental challenge of owning affordable rental portfolios.

Using quarterly data reported to NeighborWorks America through a platform created and managed by the Compass Group, we looked at the data of NeighborWorks network members to try to find some answers about achieved affordability.

Relying on Gross Potential Rent (GPR) data and excising some properties, which had a level of rental assistance, which would skew the analysis, we compared each property’s GPR with area median income (AMI). This allowed us to determine the percentage of AMI that households would need to earn to produce that GPR while paying no more than 30 percent of their income toward rent and utilities.

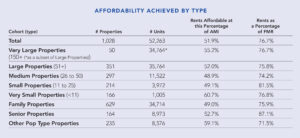

Overall, across 52,263 units, rents and utilities were affordable (30 percent of income) to households earning 51.9 percent of AMI. In our experience generally, any significantly deeper affordability requires rental assistance. Looking at property size and population served, we further found:

- Very small properties were the least affordable (potentially owing to smaller properties not benefiting from the efficiencies of scale enjoyed by larger properties, or their weighting in our data set to the utility-heavy Northeast);

- Family properties were more affordable than seniors’ properties (potentially related to the higher rents on larger units more than offsetting the incrementally higher cost of operating larger units, but also perhaps reflecting the higher (adjusted) AMIs of households in larger units); and

- Very large properties (150+ units) were affordable at 55.2 percent of AMI, and this higher rent level could potentially be attributed to more professional management, scale and market orientation.

Across most of these property types, the affordability may also be a consequence of rent increases, which have not kept pace with increases to the AMI, whether intentional or inadvertent. But household incomes themselves may have fallen yet further behind; anecdotal evidence suggests that while owners develop and manage to the LIHTC income thresholds of 50 to 60 percent of AMI, actual incomes may be closer to 40 percent of AMI.

Rental affordability can be viewed in the context of AMIs and the ‘30 percent standard,’ but it can also be viewed in the context of market. Irrespective of the percentage of income required to afford the rent at an affordable property, we wanted to look at where these properties’ rents were relative to the alternative: market rents. Optimally, we would commission 1,028 rent comparability studies, but since that approach wasn’t practical, we compared property rents to The Department of Housing and Urban Developments’s Fair Market Rents (FMR), which establish the 40th percentile of rents in each market. Fortieth percentile rents could be assumed to be neither luxury nor substandard.

Rents among our properties overall averaged 76.7 percent of FMR. This provides a strong indicator that these properties reflect an almost 25 percent discount against the market. We know, of course, that in some weaker markets market rents can be at or below levels affordable at 60 percent of AMI.

The benefit to the renter is clear. But what of the cost/benefit to the taxpayer? Extrapolating the value of these achieved rents (and the savings to residents) over time highlights their value. These 52,263 units had actual rents averaging $890 per unit per month (PUPM). For comparison purposes these average rents were $159 below rents affordable at 60 percent of the AMI and were $411 below rents affordable at the FMR. Assuming FMR as a proxy for market, over a 20-year horizon, the actual rent is worth $98,640 in ‘below market’ benefit to a renter (i.e., $411 per month, times 12 months, times 20 years). If the public investment of tax credits and gap financing totaled less than this amount, then the public benefit was greater than its cost. That is, the taxpayer got more than she paid for. And while we calculated this broadly, this same cost-benefit analysis could be done for any property as a framework for understanding and appreciating the public investment value.

Having examined affordability from the property and public financing perspectives, we can ask what the affordability means from the rent-paying resident’s point of view.

At the 2021 (100 percent, four-person) U.S. AMI of $79,900, a household in a two-bedroom apartment and earning 50 percent of AMI has income of $2,996 per month. At 30 percent of income toward housing costs (the affordability ‘standard’) an affordable housing cost (rent plus utilities) is $899, which leaves $2,097 to live on. For this two-bedroom, three-person household, this equates to $23 per person, per day for non-housing costs: food (three meals per day), cell phone, transportation, clothing, school supplies, prescription drugs, cable TV and everything else. And while we incorporate a utility allowance, we do not provide for internet access, which the pandemic showed us is a vital utility. This brings us back to our earlier point: that a key element of quality affordable housing is lower cost—and that a low-income household, minding its budget and living frugally, may easily find rent and utilities at 30 percent of income to be unaffordable.

The traditional approach to affordability not only fails to be affordable: It is inequitable. Rents of 30 percent of a lower income leaves a lot fewer dollars for daily life than it does for a greater income. Rent caps at 30 percent of AMI yields negative Net Operating Income. And other data demonstrates that that already inequitable burden falls more heavily on populations of color.

What can be done?

Owners and operators of mission-oriented housing can:

a) Recognize the impact of higher operating expenses: seek efficiencies in operating properties with essential affordability mission obligations, including bulk purchasing, energy usage and risk management;

b) Do the analysis: understand the percentage of actual income being paid by your residents, the level of AMI at which your rents are affordable, and the value of that relative to market. Let this guide thoughtful decision-making about rent increases (including the possibility that with sufficient sophistication rent increases can be implemented to dynamically correspond to household incomes). Let this information about actual affordability support the story of resident stability, not merely regulatory compliance; and

c) Use portfolio strategies to leverage profits from less affordable assets toward subsidizing the income of more affordable assets. Because of the demands of our properties and the constraints imposed by affordability, we need to broaden our strategies, including mixed-income and mixed-use, to fund the immediate needs of residents and the long-term needs of the properties.

The affordable housing industry can:

a) Begin measuring the relationship between the value of the affordability achieved against the public cost to achieve it. If public investment of $10,000 achieves a rent benefit $20,000 over the period of affordability, this is a strong outcome, which should be marketed toward greater funding for housing;

b) Seek to detach AMI-based income qualification requirements from AMI-based rent levels (as against the industry standard of using the same AMI limit for both of these elements). For example, a unit that permits a 60 percent AMI income, but limits to a 50 percent AMI rent, will provide a rent that is 25 percent of income; and

c) Develop better measures to demonstrate the financial value of resident services.

NeighborWorks America creates opportunities for people to live in affordable homes, improve their lives and strengthen their communities. To support the organization’s mission, we manage the balance of resident stability, property sustainability and organizational strength. If America is to be a Land of Opportunity, affordable housing needs a high enough quality floor that it is a gateway to opportunity rather than a barrier to it. But we must seek ways to reduce rents to the neediest if we are to achieve more equitable housing.

Harold Nassau is the senior director of Asset Management for NeighborWorks America, a federally chartered network that includes 135 local CDCs that own over 140,000 rental units across all 50 states. NeighborWorks’ member organizations are committed to serving the neediest in their communities, often targeting families at less than 30 percent AMI while still providing quality housing that is sustainable for the long-term investment horizons that the tax credit program and extended use regulations may require.

Anker Heegaard is a principal with the Compass Group Affordable Housing, a consultancy specializing in affordable housing transactions, finance and policy for government and nonprofit clients.