Pipeline of Multifamily Homes Slated for 2024 Completion Mutes Rental Market Growth

Freddie Mac 2024 Multifamily Outlook Cautiously Optimistic on Economy and Multifamily Housing Market

By Nushin Huq

6 min read

While the multifamily market is expected to grow in 2024, growth will be muted due to supply and demand forces, according to a report by the government-sponsored enterprise, Freddie Mac.

The 2024 Multifamily Outlook (released in December 2023) predicts the year ahead for the multifamily market, focusing on macroeconomic drivers impacting the market, performance at the national and metro level, forecasts for the year, and trends among capitalization rates and property values. In 2024, a completed peak multifamily construction is expected to moderate rent gains, the report says. While researchers expect positive rent growth in 2024 due to market trends, it will be below longer-run averages.

The report focuses on macroeconomic drivers impacting the market saying, “The multifamily market may see additional strain from continuing high levels of new supply and higher interest rates but remains a favorable asset class given the expensive for-sale market and demographic trends.”

At the time of the report’s publication, just under one million units were under construction, with most of those units expected to be completed in 2024 and expected to keep rent growth below long-run averages and vacancy rates above. Positive overall rent growth in 2024 will feel slow in comparison with pandemic boom years, as well as the years leading up to it, the report says.

Supply and Demand

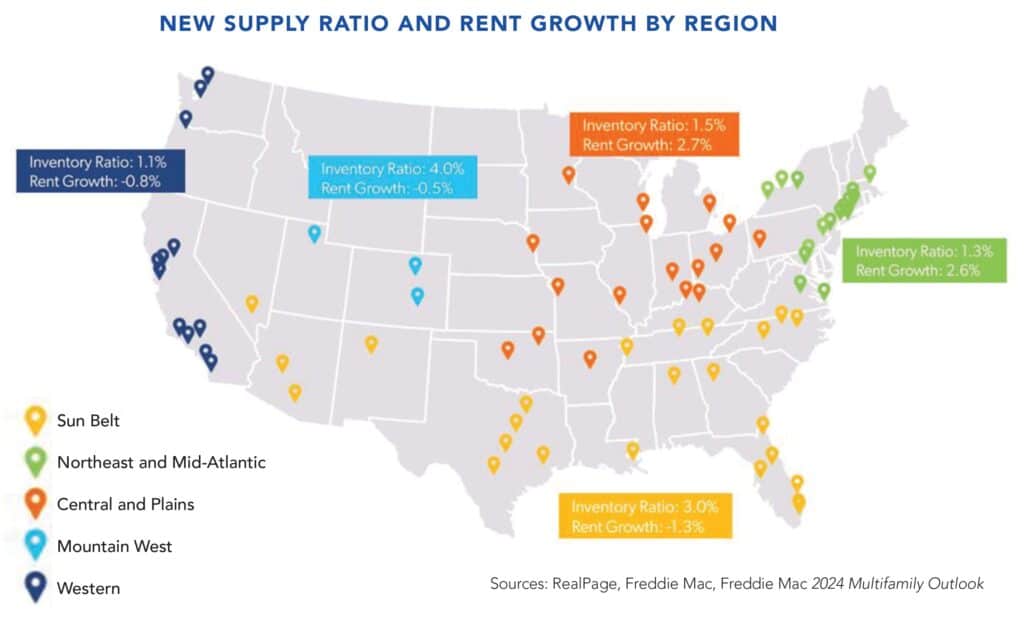

The impact of increased supply will not affect all markets similarly, the report says. Researchers expect bifurcated performance at the metro level. Markets that experienced high rent growth in 2021 and 2022 will be outperformed by the slower-moving secondary or tertiary markets that are less expensive – a result of increased supply. High-rent growth markets, like Austin, are now seeing a high level of new supply compared to the constrained new product pipelines in the tertiary markets.

Metro areas in the Sun Belt and Mountain West have some of the highest levels of new supply, resulting in declining rents. In addition to Austin, other cities in this category include Salt Lake City, Nashville, Charlotte and Colorado Springs.

On the other hand, both in the Midwest and Northeast, new supply represents 1.5 percent and 1.3 percent of inventory respectively. Not only is there less supply growth in these areas, but smaller markets in the Midwest and secondary markets in the Northeast are less expensive than more expensive neighbors, leading to rent growth in these areas. These markets include Tulsa, Rochester, Long Island, Syracuse and New Orleans, the report says.

The West Coast region has a different pattern than the rest of the country, the report notes. While new supply remains low at 1.1 percent of inventory, rents declined -0.8 percent in 2023 due to outmigration trends instead of increased new supply putting downward pressure on rents.

The multifamily market may see additional strain from continuing high levels of new supply and higher interest rates but remains a favorable asset class given the expensive for-sale market and demographic trends.

Macroeconomics

The 2024 Outlook assumes a soft economic landing in 2024, though researchers note that there are several risks that could derail the economy.

“That being said, current economic conditions and projections indicate we very well may achieve the soft landing that the Federal Reserve has been hoping for, but the descent may feel bumpy and turbulent along the way,” the report says.

Authors of the report expect job, wage and gross domestic product growth to slow but remain positive, as inflation continues its downward trajectory. With an economic soft landing, the multifamily market will continue to see slow growth while it works to absorb the high level of new supply in 2024, the report says.

On the other hand, risks, such as over-tightening by the Federal Reserve, an oil price spike, expansion of global conflicts, property price collapse and a flattening of the banking system, could derail the economy. Moody’s estimates a 25 percent chance the country will slip into a recession next year – slightly higher compared with historical averages, the report says.

If the economy falls into a recession in 2024, the multifamily markets will face additional upward pressure on vacancy rates and downward pressure on rents caused by lowered demand. Supply would remain high because the pipeline of new units to be delivered in 2024 would remain high.

On the other hand, if the labor market remains strong, the projected occupancy rate will be less impacted and only improve marginally compared with the original forecast, the report says.

Interest Rates

Interest rate increases by the Federal Reserve seem to be over, but higher interest rates will probably remain in 2024, resulting in more price discovery in 2024 as buyers and sellers adjust to the current higher interest rate environment, the report says. While capitalization, or cap rates, have increased over time, “gauging the cap rate increase” has been difficult due to limited transaction data and sourcing. Interest rate stability could help drive transaction volume in the multifamily market.

“With interest rate stability, cap rates and property values should stabilize allowing buyers and sellers to agree on asset value to facilitate more transaction volume,” the report says.

Interest rate stability could spur multifamily lending for the year, the report says.

We expect volume growth to return in 2024, up to $370 to $380 billion, which is in line with the 2019 volume, but well below the post-pandemic years of 2021 and 2022.”

Buying vs. Renting

Despite the highest mortgage rates in over 20 years, the for-sale housing market remains tight, driven by seniors staying in place more than anticipated and hesitancy by homeowners who locked in historically low interest rates during the pandemic to move. The tight market results in continued home price appreciation despite high mortgage rates, the report says.

In turn, the more expensive for-sale market will keep many first-time homebuyers renting longer, the report says.

“While this does not create long-term demand, it will help keep units occupied, especially as new multifamily supply enters the market,” the report says.

The report concludes that despite the short-term supply headwind in 2024, over the longer term the multifamily market will continue to be supported by the overall shortage of housing, an expensive for-sale housing market and the next generation of renters entering prime renter age.

Freddie Mac’s midyear outlook is scheduled for publication by the end of July.