Social Impact Financing: An Alternative to LIHTC

By Douglas P. Koch

8 min read

The Low Income Housing Tax Credit (LIHTC) has traditionally been the driving force behind creating equity in the affordable housing industry. However, this industry is also developing new and innovative ways to finance affordable housing and community development including soft debt, philanthropic, non-bank debt and social impact financing.

Soft debt is an on-going important financing component for LIHTC developments. With longer terms and payments, soft loan payments are generally made from available cash flow. This allows the properties more flexibility during their life cycle since there is no required debt service, making more cash available for the preservation of the property. Some challenges associated with this financing include increased compliance and additional complexities at the time of restructuring.

In addition to traditional LIHTC equity and soft debt financing, a few organizations have begun using social impact financing (“SIF”). Defined as investments that provide an economic and social return, SIF investments seek environmental, social, economic, innovational and cultural benefits. SIF has grown to be a $50 billion market over the last 20 years, with a market potential of $3 trillion in the next decade. Initially, SIF focused on government involvement with international investments. Recently, SIF has drifted towards domestic investments, including housing related services and assets. Approximately 22% of SIF investment is in North America, with 8% allocated to housing.

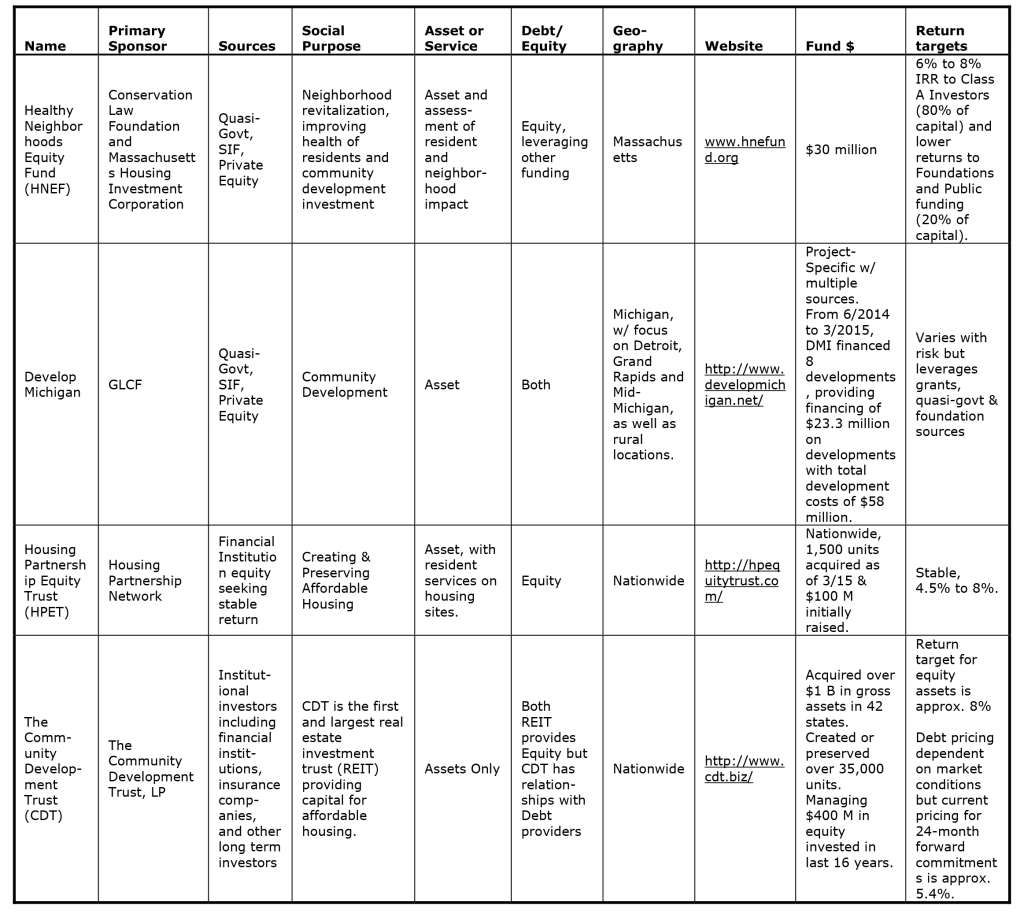

LIHTC syndicators, other financial intermediaries, non-profit associations, and university organizations created start-up funding mechanisms to connect SIF funding with existing affordable housing, community development and community service activities. Financial intermediaries are now developing specific funding mechanisms that promote affordable housing, community development and recapitalization without LIHTC. The four organizations profiled below have active funding initiatives available within the LIHTC and community development arena.

Each of these funding initiatives invests non-LIHTC equity (including foundation, quasi-government, private equity and financial institutional investments) in community development and affordable housing developments, often coupled with resident services providing measurable impact to occupants, residents and communities alike:

The Housing Partnership Equity Trust (“HPET”-http://hpequitytrust.com/)

HPET is a social enterprise formed as a real estate investment trust (“REIT”) devoted to acquiring and preserving multifamily housing occupied by lower income tenants. It offers investors the ability to earn potential returns of 4.5% to 8.0% as well as promote measurable social outcomes. Formed by the Housing Partnership Network (HPN), it leverages the resources, experience and geographical reach of 12 of its non-profit members that operate over 60,000 affordable units representing over $5 Billion in real estate. HPN is a member-driven business collaborative of 100 housing and community development nonprofits in the country. Founded 20 years ago by entrepreneurial nonprofits that combine social mission with private enterprise, the HPET is an innovative solution to one of the nation’s challenging problems: preserving and maintaining affordable housing within the conventional marketplace.

HPET’s 12 non-profit members have a nationwide reach and include AHC, Inc., BRIDGE Housing Corporation, Chicanos Por La Causa, Community Preservation and Development Corporation, Eden Housing, Hispanic Housing Development Corporation, Homes For America, Inc., LINC Housing Corporation, Mercy Housing, Nevada HAND, Inc., NHP Foundation and NHT/Enterprise Preservation Corporation. Thus far, HPET has invested over $100 million in seven developments (1,500 affordable units) located on both coasts as well as the Mid-West.

Develop Michigan (“DMI”- http://www.developmichigan.net/)

Develop Michigan is the first non-governmental privately operated development finance organization in the country, providing financing that is not otherwise available through traditional sources. Develop Michigan (DMI) was formed to drive economic progress through a strategic partnership with the Great Lakes Capital Fund, Development Finance Group, MEDC (State of Michigan) and private investors. DMI seeks a diversified portfolio of commercial and residential real estate, encompassing apartments, mixed use, and industrial complexes aimed at providing significant economic and development benefits to Michigan communities.

Using its comprehensive management skills and regional market expertise, DMI applies its flexible financing to complex debt restructurings, existing asset rehabilitations, redevelopment, repurposing, and value-add for under-performing assets. DMI provides traditional fund management as well as annual reporting of social impacts based on an independent economist’s analysis. DMI’s double bottom line strategy seeks impactful investments that spur economic development, create jobs, revitalizes communities and aids in infrastructure recovery. In the last ten months, DMI has financed eight developments, providing financing of $23.3 million on developments with total development costs of $58 million.

Healthy Neighborhoods Equity Fund (“HNEF”-www.hnefund.org)

The Massachusetts Housing Investment Corporation (MHIC) and the Conservation Law Foundation (CLF) are joint sponsors of the Healthy Neighborhoods Equity Fund (HNEF). HNEF will invest in high-impact real estate projects that have the potential to transform neighborhoods, strengthen community and environmental health, and promote regional equity while providing attractive risk-adjusted returns for investors. HNEF will provide patient, early-stage capital for catalytic residential, commercial, and mixed-use projects and help to leverage other sources of private and public financing. HNEF I is a $30 Million all equity fund with a quadruple bottom line: Financial Returns and Community, Environmental and Health Benefits. Target fund returns include a 6% to 8% IRR to Class A Investors (80% of capital) and lower returns to Foundation-supported and Public funding (20% of capital).

As a long established (1990) financial intermediary providing LIHTC and NMTC equity capital for affordable housing as well as community development, MHIC is looking to deploy non-tax credit capital for community development that would not necessarily fit the narrow investment qualifications of LIHTC or NMTC. Early investment pipeline considerations include mixed-use residential, retail and commercial developments. Identified by planning authorities as high-impact areas for investment, the initially targeted sites are located in transit corridors in greater Boston and commuter rail station areas in several suburban or Gateway Cities.

While each of the funds profiled plans to measure social impact, CLF, as a partner in the HNEF I, is specifically charged with conducting the neighborhood health impact measurement. Impact elements to be measured include overall walkability of the site and area, distance to transit, access to new jobs, access to fresh and healthy food, access to green space and recreational, conformity with crime prevention requirements and compliance with higher construction standards that promote indoor air quality, energy efficiency, conservation and a cleaner environment.

The Community Development Trust, LP (“CDT”- http://www.cdt.biz/)

While the three funds profiled above developed over the last few years, CDT was formed over 16 years ago. The Community Development Trust, Inc. (CDT) was formed as a real estate investment trust (REIT) with a public purpose: to provide long-term capital for the preservation and development of affordable housing. CDT is now is one of the largest and best-capitalized CDFIs in the country. The predecessor company to CDT was the Local Initiatives Managed Assets Corp. (LIMAC), an affiliate of the Local Initiatives Support Corporation (LISC). LIMAC’s President, Judd S. Levy, came up with the concept of creating a REIT focused on community development. Paul Grogan, President and CEO of LISC, supported the idea and LISC provided the seed capital for the initial investment in CDT. After forming the REIT, a first in the community development industry, Levy, as its first President and CEO, recruited new staff with significant real estate experience and, together with the existing LIMAC team, launched CDT.

CDT is a national investor in affordable housing. Working with local, regional, and national developer, financial and operational partners, CDT makes long-term equity investments, originates, and acquires long-term mortgages. In its fifteen years, CDT has invested over $1 billion in debt and equity ($400 M) capital to properties in 42 states and regions — helping to preserve and create nearly 35,000 units of affordable housing. As a private, mission-driven REIT, CDT has demonstrated the ability to preserve and expand the supply of affordable housing while also earning attractive returns for shareholders.

If you are interested in learning more about either of these funds or accessing their capital, the chart below provides contact information and more detail.

In Europe, Asia and Africa, governments have provided financial support for SIF investments for several years. SIF has begun to gain more national government financial support in the U.S as shown by the bi-partisan support for up to $800 million in SIF in Representatives Todd Young and John Delaney’s Social Impact Partnership Act (http://toddyoung.house.gov/social-impact-partnerships/) as well as the White House’s Pay for Success Initiative. (https://www.whitehouse.gov/blog/2015/03/11/new-pay-success-grants-help-communities-advance-what-works)

Ever since the Housing Act of 1968, affordable housing and community development finance has a strong private-public partnership and has accessed multiple sources of government, foundation and private financing. The advent of SIF funding will lead to a better use of the private-public partnership for environmental, social, economic, innovational and cultural benefits.